Putting your eggs in one basket

If we were completely confident about the performance of our investments, there would be no point in spreading them around to avoid risk. We would simply put all our eggs in one basket, and invest where the results were going to be the best.

The only reason that investors balance their portfolios is because they aren’t confident about the outcomes, and so they diversify to minimise any potential risk. The logic is that if one of their property investments falters, good performance in the others will still give them an acceptable overall result.

However, spreading your investments around by choosing different types of properties, different locations or even buying in different States doesn’t necessarily cut any potential for loss, because all the areas or types of property or types of property you have chosen still be at risk.

Let’s look at some of the most common strategies investors use to minimise their exposure to risk and see which of them makes the most sense.

Spreading properties between capital cities and regional areas

Australia’s regional property markets do occasionally outperform capital cities, but their performance is far more volatile This is because housing demand is often limited to one or two sources, such as mining or tourism, or when large numbers of buyers periodically relocate to regional areas.

This means that if there is strong evidence that a particular regional or rural market is about to boom, it will still be important for you to identify the cause, so that you can “time” the right moment to invest and anticipate when the growth is about to end.

This means that if there is strong evidence that a particular regional or rural market is about to boom, it will still be important for you to identify the cause, so that you can “time” the right moment to invest and anticipate when the growth is about to end.

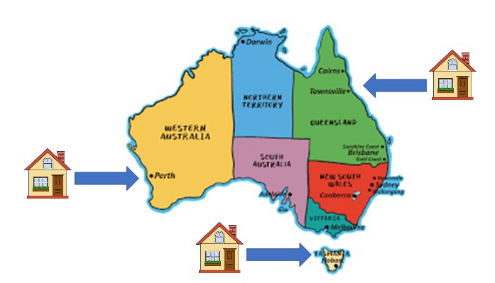

Diversifying in different States

Some investors believe they can minimise their risk by purchasing their properties in several different States or Territories.

However, this can lead to a huge mistake being made if the properties are all located in the same type of market.

For example, you might diversify your portfolio across several States, but if they are all located in towns with a reliance on the same industry such as mining or tourism, then they are all still located in the same type of market, which means that you haven’t really balanced your risk at all.

Buying several different types of properties

Other investors diversify by purchasing different types of properties, such as houses, units, townhouses, duplexes and apartments.

Unfortunately this doesn’t reduce risk, because each of these types of property can perform differently, even in the same suburb.

Always invest in areas with the greatest potential housing demand

Irrespective of where you decide to invest, you need to look at the single most important fact about housing investment. The best investments will always be where the demand for housing is so great that it leads to housing shortages.

Strong rental demand delivers cash flow

Rental markets are far more volatile than owner-occupier markets, because the people who live in the dwellings don’t own them, while the investors who own them don’t live in them.

This volatility provides opportunity as well as risk.

Rental markets can offer you high positive cash flow, but also high risk if the rental demand slows down or the market is over developed with new dwellings being sold to investors.

Strong buyer demand delivers price growth

If you are seeking sustained capital growth without speculative risk, you can choose from first home buyer markets located in urban growth corridors and outer suburbs, upgrader areas situated in well-established upper socio-economic areas and downsizer locations located in attractive retiree destinations.

If you are certain that one type of market is about to boom, it makes sense to concentrate all your properties in that type of market.

The only diversification you might then make would be to minimise State land taxes and the impact of natural catastrophes such as floods, bushfires or cyclones.

This is why it is best to limit the diversification of your portfolio to those types of markets which have the best potential to provide the outcomes from property investment that you are looking for.