How the snowball effect creates booms

Housing markets sometimes produce unexpected and dramatic periods of growth after many years of price stagnation. John Lindeman explains that this occurs when the demand for housing starts to exceed the supply of available properties, leading to a snowball effect.

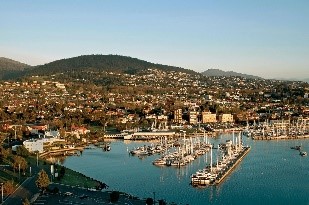

Hobart is one of our prettiest cities, framed by majestic Mount Wellington and the sparkling waters of the Derwent Estuary. A decade ago, it was also the cheapest capital city in Australia to buy property, with a typical three-bedroom house costing around $350,000, half of the then median price in Sydney.

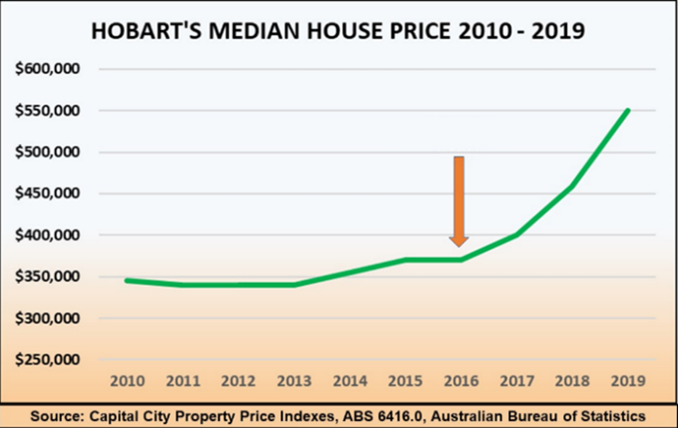

As the graph shows. From 2010 to 2016 Hobart experienced very little price growth giving investors or developers no incentive to buy or build property. Yet the city’s population was quietly growing, generating demand for around 1,000 new dwellings each year. Because of the lack of new housing development, virtually all buyer demand was for established properties.

By mid 2016 a tipping point was reached, as the demand for housing was higher than the number of dwellings for sale.

Hobart’s house prices suddenly boomed with a fifty percent rise occurring in just three years. This led many experts to speculate on what had caused Hobart’s property market to boom so unexpectedly.

The snowball effect is created by a growing shortage of properties

Hobart’s house prices started to rise because the demand for properties had begun to exceed the number for sale.

Constant buyer demand caused the supply to keep falling, creating a snowball effect as prices started to escalate. Hobart was Australia’s best performing capital city housing market for the next three years.

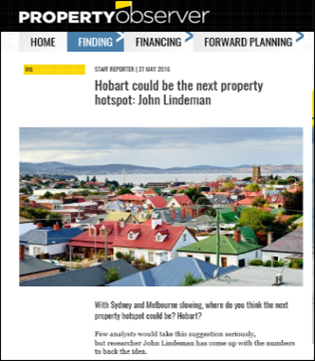

Predicting Hobart’s housing market boom

Back in early 2016 our Housing Market Prediction Solution revealed that the number of properties listed for sale in Hobart was declining, and that potential buyers were beginning to outnumber the supply of properties available for purchase.

The lack of new housing meant that buyers had to compete for established properties. As listings were falling rapidly, it was obvious that the snowball effect was about to occur, and I made my now famous Hobart boom prediction in the property media.

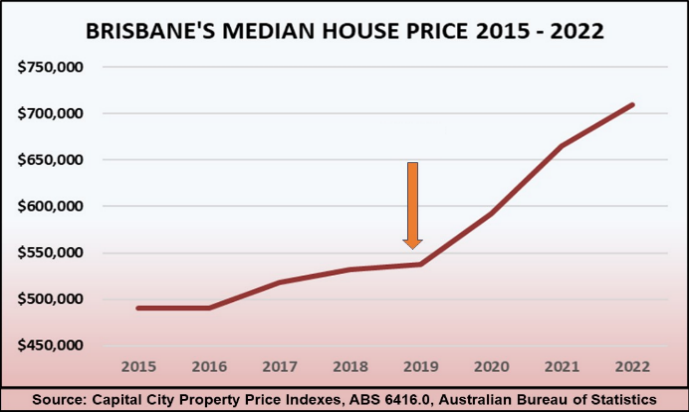

The Brisbane property market boom from 2019 to 2022

Brisbane’s property market has seen house prices more than trebling in the last three years due to the same sequence of events.

Before 2019 the city’s population growth rate of nearly two percent was creating a need for 20,000 new homes each year. But there had been little price growth and Brisbane’s median house price remained below $550,000.

Developers could not compete on price with established homes and the rate of new housing builds slowed down.

The Brisbane property market reached its tipping point in 2019 and over the next three years, Brisbane’s housing prices have boomed, with property values growing by over one third as buyers compete for the stock remaining.

Which city will experience the snowball effect next?

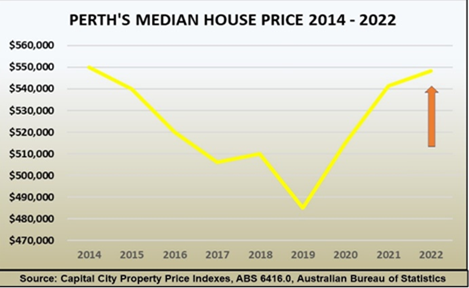

Perth’s population continues to grow and there’s a need for around 15,000 new homes each year. However, Perth’s median house price of $550,000 has only just recently recovered back to where it was a decade ago. This has led to little interest from investors or developers and housing construction numbers have declined in recent years, with developers unable to compete on price with existing dwellings.

Is Perth’s housing market about to experience a similar snowball effect to Hobart and Brisbane? To find out we consulted our Housing Market Prediction Solution.

This shows that the number of listings in Perth has been falling and that buyer demand is now higher than the number of properties for sale on the market.

There is every indication that house prices could start to rise strongly in Perth and based on our studies of the snowball effect, Perth could become Australia’s best performing capital city housing market over the next few years.