The compounding growth myth unmasked

Ever heard of the power of compounding growth? You’ll often see it promoted as the reason that property investment can provide such great results. But does it really work? John Lindeman investigates.

Many experts assure you that property investment is a long term game because prices always rise over time. Future growth builds on past growth, delivering the snowballing result called compounding growth.

Because of the power of compounding growth, some strategists even insist that timing the market is futile. By this they don’t mean that its future performance is unpredictable, but that it is simply unnecessary to try and predict the future – all we need do is buy and hold.

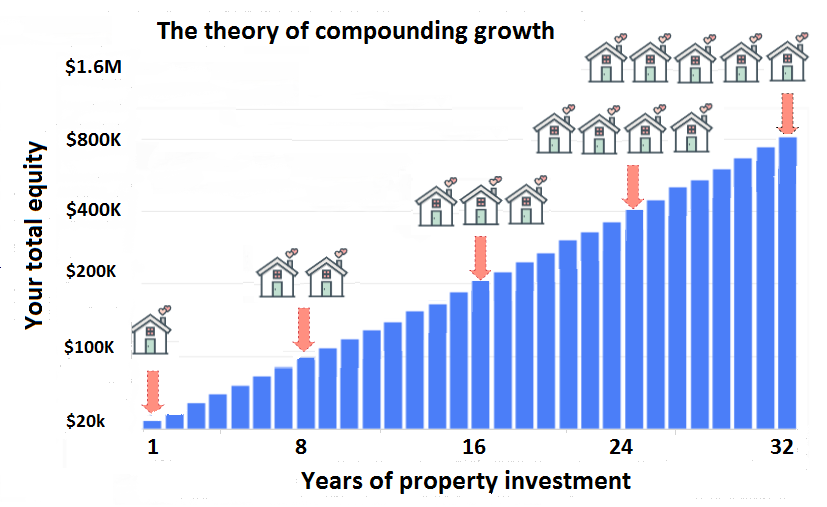

They point to the long-term performance of property and show you how its regular and consistent price growth exponentially increases your equity over time, as demonstrated in this commonly used illustration of the power of compounding growth.

Compounding growth seems to offer you a secure pathway to wealth, because as your equity grows, you keep buying more properties until you reach your final goal.

Most investors only ever get to own one or two properties

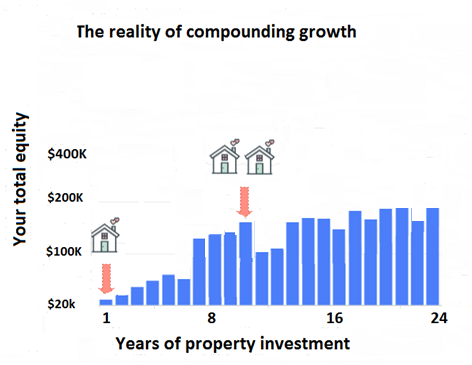

If only this were true! Yet the facts are that very few property investors own more than two properties. According to the ATO1, ninety per dent of property investors only own one or two investment properties and are seemingly unable to make the power of compounding growth work for them. But that’s because the theory doesn’t work in practice, for two very critical reasons.

Firstly, unless your properties generate positive cash flow, you will quickly hit a borrowing ceiling, because banks won’t lend you any more money. Most properties are negatively geared, which means they cost more to hold than the income they generate, so you are actually losing money, and your borrowing power is quickly exhausted.

Secondly, although property prices do go up over time, price growth can dramatically vary from one location to another, even at the same time. Some areas may not experience price growth for a decade or longer, while others experience short but sharp bursts of growth which are then followed by years of price stagnation.

Theory and practice are different

Einstein once said, “In theory, theory and practice are the same, but in practice, they are different.”

The chances of hitting a property jackpot are slim indeed if we buy and hold without achieving both consistent positive cash flow and high price growth.

This is why most investors never get past owning one or two investment properties.

Their experience shows us that relying on the power of compounding growth alone is totally flawed.

Those few investors who have managed to increase both their equity and portfolio over time and achieved their wealth creation goals have a secret – they always purchase the right properties in locations with high positive cash flow as well as the potential to generate high price growth.

Source:

1 How many properties do investors own? Michael Yardney, YIP Mag blog 12 Dec 2018.