The sleepers set to boom

Many locations in Australia are heading for what could be their biggest property market boom ever. John Lindeman explains why this is about to occur and which of the sleepers are set to boom.

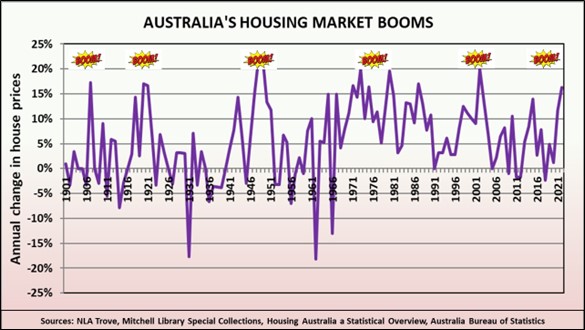

Did you know that we have only ever experienced six housing market booms since our nation began? They are shown on this graph, and they were all generational property market booms, beginning when each new generation decided to buy their first homes at the same time.

All our property market booms have been generational

You can clearly see the Federation boom in the early 1900s, the two post-war baby booms of 1919-1922 and 1947-1951, the baby boomers buying their first homes in the 1970s, the Gen X buying boom in the early 2000s and more recently, the Millennial home buying boom which started during the Covid years.

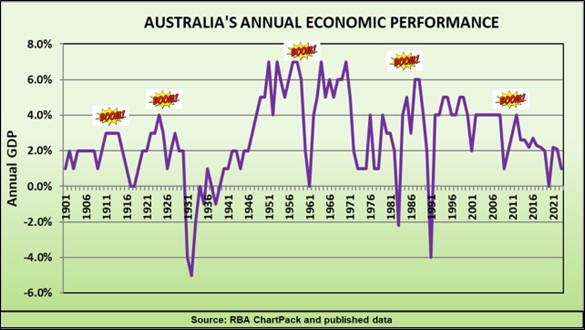

When housing booms, so does our economy

What’s even more significant for investors is that each of these housing market booms has created economic booms. This is because housing demand directly stimulates the financial, construction and business sectors, and indirectly generates around one quarter of our economic growth.

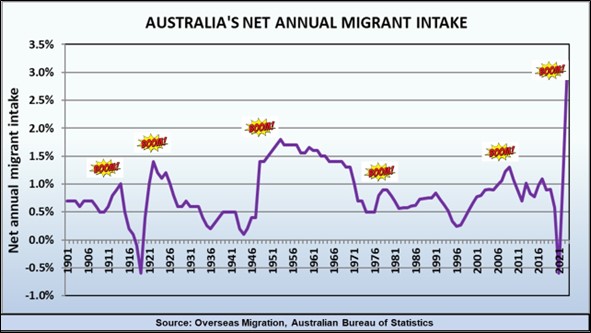

When the economy booms, so does migration

Because of our relative isolation, Australia has been able to avoid the direct impact of wars, social unrest, economic crises and other disasters experienced in other parts of the world. When such catastrophes occur elsewhere, we are seen as a peaceful and prosperous safe haven and huge numbers of migrants and refuges decide to start new lives here.

As the graph shows we are once again receiving record numbers of permanent overseas arrivals from economically and socially troubled parts of the world and this trend is likely to increase over the next few years.

These new arrivals not only generate more demand for housing, they also stimulate our economy by creating new business enterprises. There has always been a strong connection between migration, economic growth and housing market booms, but the third graph shows that we have yet to reach this point, because our international borders have only been open for a relatively short time.

Housing prices can double in a few years

In every one of the five property market booms that Australia has experienced before the last boom, housing prices more than doubled in just a few years. So all the conditions for another boom are in place – we have just experienced the Millennial home buying surge and are in the middle of a massive migrant intake.

As my three graphs indicate, we can now look forward to an economic boom kicking off, followed by the potential for property prices to double in the next few years. Even though house prices have slumped in recent months, we are still in the beginnings of a housing market boom.

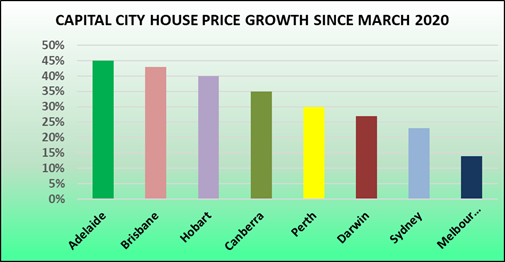

As the graph shows, property prices are well ahead of where they were when the current boom started in 2020. In some cities, such as Perth and Adelaide, housing prices are currently at record highs, while the average capital city growth since March 2020 is 25 per cent.

Even though every capital city has experienced price growth over the last three years, the variations extend not just between cities, but to their suburbs as well, with some locations booming while others have experienced little to no growth at all.

Locations which suffered most will have the greatest growth potential

In years to come, the current slowdown will be just a tiny dip in a sea of price growth and investors have a unique opportunity to benefit.

This is because the locations with the greatest potential will be those which suffered most during the lockdowns and border closures.

As the dynamics of our housing markets undergo a complete reversal, those locations which experienced years of low demand with little to no price and rent growth will be sleepers set to boom.