Bubble, boom or bust - what lies ahead?

Some experts are claiming that our property markets are heading for a boom, while others are warning that we could soon be in a price bubble about to bust. John Lindeman gives us his take on what lies ahead.

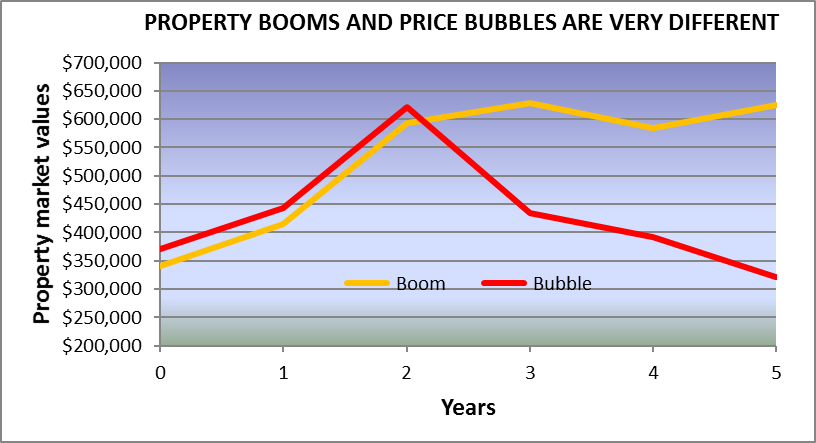

There’s a huge difference between property booms and price bubbles. Bubbles invariably bust and when they do, housing prices end up much lower than where they started. Property booms, on the other hand eventually run out of steam with an occasional small price correction followed by a prolonged period of little to no growth.

The issue is that they both look the same at the start, as this graph shows.

So what’s the difference between a boom and bubble? It’s the type of buyers causing the growth. Buying demand from investors grows when prices rise and the more that they increase, the more that investors want to buy properties. Owner-occupier booms take place despite price growth and the more that prices rise, the more that demand slows down and then stops as prices become unaffordable.

Only investor led booms can become bubbles

Investor led booms can become bubbles because investors don’t buy properties to live in, like owner-occupiers do. Profit is their only consideration, and fear of loss their only concern.

This means that when price growth slows down or stops, investors start to put their properties on the market and try to sell. When the number of properties for sale exceeds buyer demand, prices start to fall. Panic starts to set in as more and more investors try to sell and because no one wants to buy, the bubble busts.

Owner-occupier booms merely slow down and when they end prices don’t crash, because the purchased properties are now people’s homes. When buyer demand comes to an end, there’s no motivation to sell. Only those home owners who really need to move for personal, family or business reasons will do so.

Property booms can occur anytime and anywhere that the demand for housing outpaces the supply, but only investor led booms can turn into bubbles.

So what type of property boom are we in right now?

There’s a simple benchmark that tells us the type of boom taking place right now, and therefore what is likely to occur when the boom has ended.

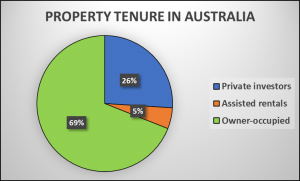

The benchmark is called tenure, a technical term that refers to the conditions by which homes are held or occupied.

The pie chart shows the percentage of homes privately rented, those rented from government agencies and those which are owner-occupied.

You can see that just over one quarter of homes in Australia are rented from private investors, so if the percentage of homes being bought by investors is lower than this, then owner-occupiers are driving buyer demand, but if the percentage climbs higher, then we are heading for an investor led boom and a possible bubble that could bust.

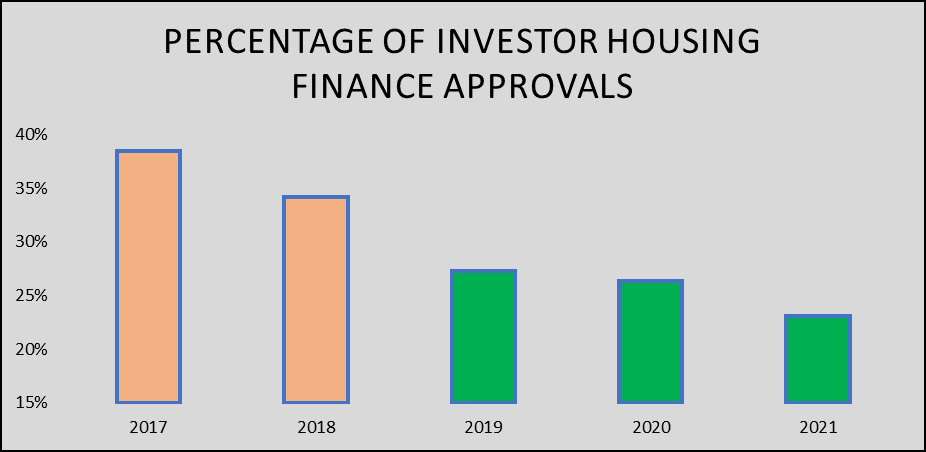

This next graph shows the percentage of homes being purchased by investors and reveals that they have been lower than the 26% benchmark since 2019, and also that the percentage of investors buying homes is declining.

Investor interest in residential property has waned in recent years because rental demand is falling and the yield from rent is too low. Investor interest has turned instead to high yielding investments such as shares, commodities and even commercial property. Owner-occupiers are not deterred by low rental yields, because they buy properties to live in, not to rent out.

The current mix of low interest rates, easy finance, reduced repayment buffers plus government incentives and waivers is causing the current surge in owner-occupier demand and when the new affordability ceilings are reached, growth will slow down and then end, but it won’t bust like a bubble.