Know the best time to buy, hold or sell

by John Lindeman

Every investor needs to know whether it’s the right time to buy, hold or sell their properties. While there are many numbers, statistics and indicators out there ready to help your decision making process, not all of them are accurate or reliable and some are even misleading.

Investors are bombarded by a seemingly endless array of information and advice about when to buy and whether to sell their properties. Because much of this is confusing and even inaccurate, property market expert John Lindeman reveals which stats can help you to make those critical buy, hold or sell decisions.

Published property data is results driven

Most of us rely on published housing data such as sales, sale prices, rents and rental yields when making buy, hold or sell decisions. In fact, many property prediction reports you can buy use these stats to make their forecasts. But, as the image shows, this information is already months old before we get access to it.

The current market could be very different from what the published indicators are showing, because they are based on past results. This is why analysts refer to them as ‘lagging indicators’.

While this information can show you what changes have recently taken place, it can’t tell you what is likely to occur next. For that we need ‘leading indicators’ – the numbers that forecast which way the property market in any suburb is moving.

Leading indicators point the way forward

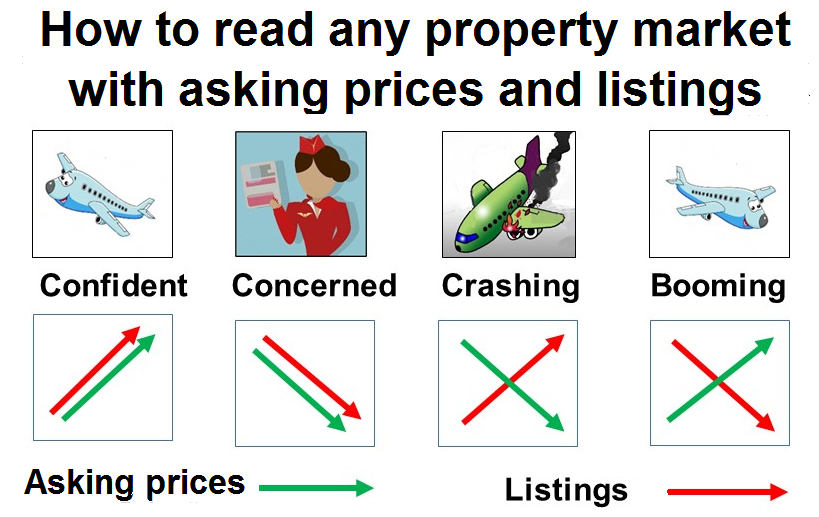

You can track current market conditions and potential changes for houses or units in any suburb by using real time indicators such as asking prices and the number of properties listed for sale. You can get these from public listing sites and they will show you any emerging trends.

To demonstrate how they work, I have used the analogy of a plane flight where the aeroplane is our property market and the passengers are potential buyers and sellers.

The take off

As the plane prepares to take off, everyone on board is looking forward to their destination, enjoying a rest, catching up on some work during the flight or the in-flight entertainment.

A few optimists might even be looking forward to the in-flight food.

For the property market, this is when anticipation is growing. Buyers and sellers are keen, with both asking prices and listings rising.

Even though prices haven’t increased significantly, investors are confident that they soon will. It could even herald another boom, but it’s too early to be sure.

The inflight safety demonstration

We’re in the air. Uh oh! Thanks for reminding us that things can go wrong. Now we have to assume the crash position, see how to use oxygen masks and check where the emergency exits are.

We are even shown how to don life vests equipped with a light and whistle. It’s not comforting to know that disaster could strike – not comforting at all.

This occurs in the property market when doubts emerge, as buyers and sellers start to pull back, suddenly aware that markets do sometimes crash. Asking prices and listings fall as we brace for the worst, but will it occur, or will we land safely?

The crash

Unfortunately, a few flights do end in disaster, and this also sometimes occurs in property markets when demand collapses.

Everyone tries to sell and no one is buying. In other words, asking prices drop and listings rise dramatically. Property prices then fall, and many investors are ruined.

The safe landing

Luckily, virtually all flights end with a safe and happy landing. The passengers are now excitedly looking forward to their holiday, business meeting, catching up with friends and family, or simply arriving home again.

In the property market, such times herald the start of a real boom.

Asking prices are shooting up and it’s hard to find properties listed for sale because buyers are snapping up properties as soon as they go on the market.

How to time the turning points in any market

Because asking prices indicate the level of vendor confidence, while listings reveal buyer demand, we need to use them together to time those turning points when buyers and sellers are becoming confident or concerned and prices may be about to crash or boom.

Here’s John Lindeman’s guide on how to read any property market and find out what’s around the corner.