Watch for the slingshot effect

Did you know that many suburbs have strong price growth potential in cities where median prices are falling?

Property market analyst, John Lindeman calls this the slingshot effect. He explains how it works and where prices are about to boom as a result.

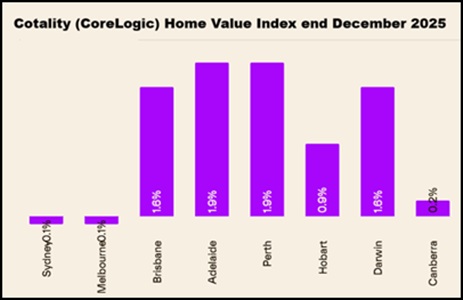

The latest property data from Cotality has given some experts quite a shock – median housing prices in both Sydney and Melbourne fell during December, while growth continued in other capital cities.

This has prompted some to declare that the booms in Sydney and Melbourne are over even before they have started, but nothing could be further from the truth.

First home buyers are making the market

The reasons that median housing prices in Sydney and Melbourne fell slightly in December was simply because there has been a huge rise in the number of first home buyers taking advantage of the 5% deposit guarantee scheme. As these buyers tend to choose the cheapest homes in the most affordable suburbs, the median price for the city as a whole gets pushed down.

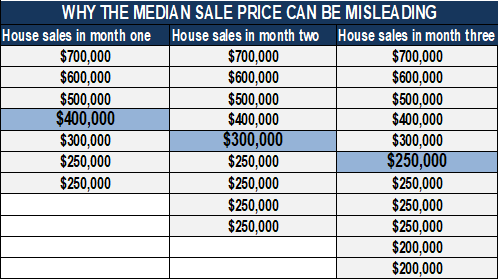

This table shows you how the median price (shown in blue) measures the middle point of all sales.

The median starts to fall when buyer demand grows in the more affordable suburbs, even though there has not been a fall in the number of sales or in sale prices above the median.

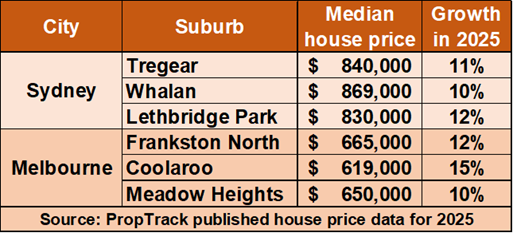

This is exactly what is occurring in Sydney and Melbourne right now. Increasing first home buyer demand is generating more sales and pushing prices up in the most affordable locations of both Sydney and Melbourne but this is hidden until we look at the actual performance of these suburbs, rather than the median price of the whole city.

The slingshot is being loaded

House prices grew by over 10% during 2025 in Sydney’s outer locations such as Blacktown, Penrith and Campbelltown. Median house prices in those areas, however, are around $850,000, well below Sydney’s median house price of $1,700,000.

Similar double digit price growth occurred during 2025 in outer Melbourne locations such as Cranbourne, Frankston, Pakenham and Melton, where prices are currently around $650,000, which is well below Melbourne’s median house price of around $1,000,000.

As long as aspiring first home buyers can secure finance, there’s plenty of room for further strong price growth, because the 5% deposit price cap is set in Sydney at $1.5M and in Melbourne at $950K.

The slingshot is fired when all the cheapies are gone

Prices in the more affordable locations of Sydney and Melbourne will continue to rise strongly and soon all the cheapies will be gone. The market will then act like a slingshot being fired with increasing numbers of aspiring first home buyers forced to compete for fewer properties. This in turn will motivate investors, especially those who tend to wait for the growth to start before they buy, and more investors will then join in for fear of missing out.

This is why it’s called the slingshot effect. At first it looks as though prices are falling, but in reality, it’s only the cheaper property sales in the more affordable suburbs that are pulling the median price down. Then, as buyer demand grows and moves into more suburbs, a property market boom results.