When will interst rates fall?

The Reserve Bank is responsible for maintaining monetary policy which encourages both economic growth and low unemployment while keeping inflation under control.

The RBA uses three key performance indicators to measure economic health:

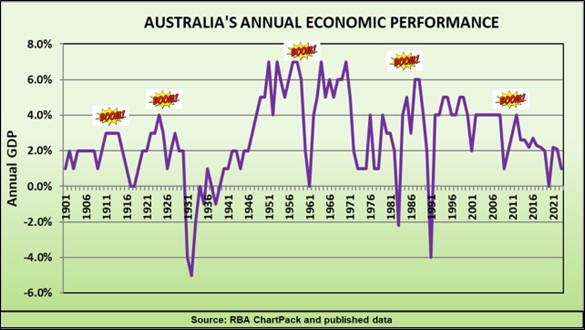

- The quarterly Gross Domestic Product (GDP) should show that our economy remains in growth.

- The unemployment rate should stay below 4.5%.

- Inflation must remain within a bandwidth of 2% to 3% over the business cycle.

To measure inflation, the RBA uses the Consumer Price Index (CPI) which is a basket of common goods and services. Any changes in the total cost of the basket indicate the rate of inflation.

The RBA does not take house prices and rents into consideration

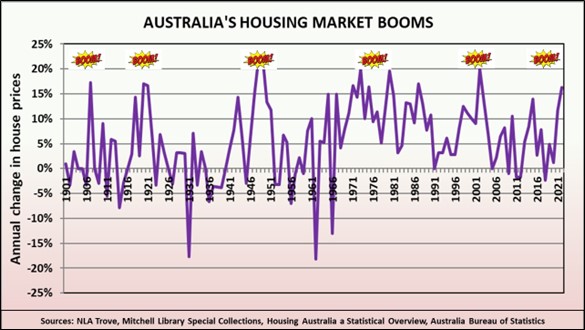

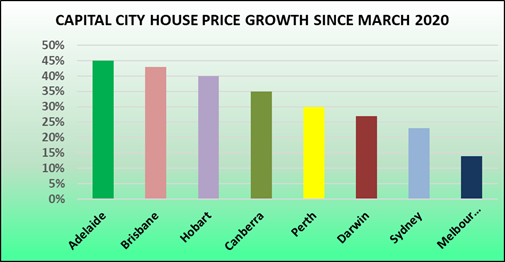

Previous RBA Governors such as Glenn Stevens and Philip Lowe have publicly stated their concerns and even “discomfort” whenever housing prices have boomed, but they have never used interest rates to boost or slow down housing prices. Instead, they have argued that such concerns need to be weighed up against the need to regulate economic activity.

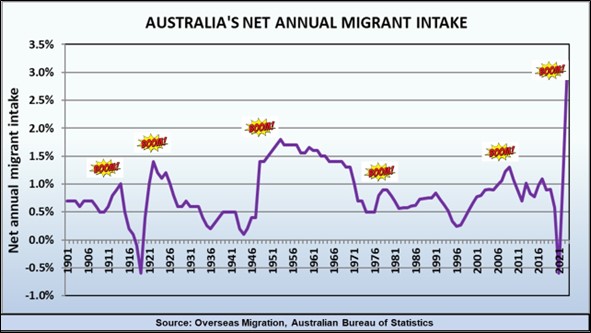

They have pointed the finger at how land and housing are taxed and the choices that our society and politicians have made that lead to high urban housing costs. In other words, the RBA believes that housing shortages and rising prices are political and social issues, but not monetary ones.

The RBA only considers housing prices and rents in terms of their inflationary impact, and housing prices and rents are already included in the CPI basket.

What prompts the RBA to change interest rates

Because the RBA relies on all three key indicators (economic performance, unemployment and inflation) together, movements in any one of these will not necessarily be reflected in interest rate changes.

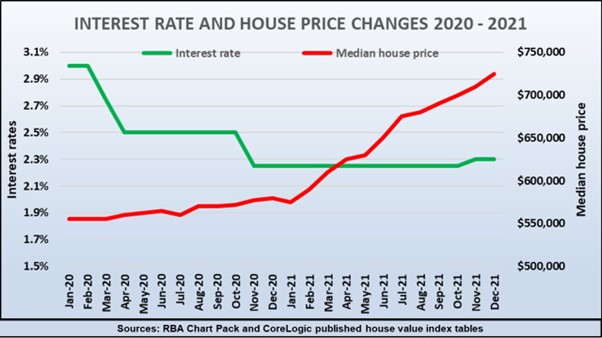

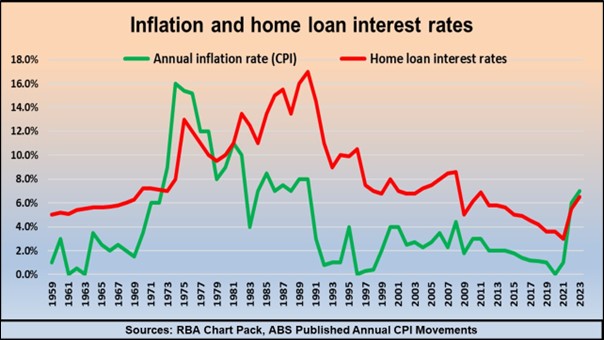

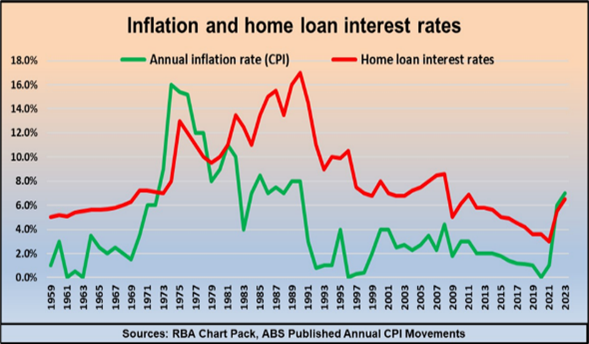

This chart shows that since 1959, home loan interest rates have generally been higher than the rate of inflation – but not always, and the difference has varied considerably over time.

The reason that the correlation has not been close is because the RBA reacts to changes to the unemployment rate and our economic performance as well to the inflation rate.

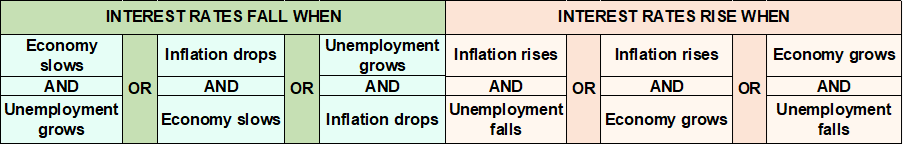

The RBA acts when two of the three key indicators change

This does not mean that the RBA waits to act until all three indicators are moving the wrong way. The RBA has used interest rates to fix things when any two of the three indicators start to go south, as shown in this table.

For example, at the start of the pandemic in 2020, the economy was about to slow and unemployment was expected to grow, so the RBA cut interest rates to record lows.

By 2022, however, inflation was rising and unemployment falling, so the RBA weighed in with a record number of rate rises.

Will interest rates fall sooner rather than later?

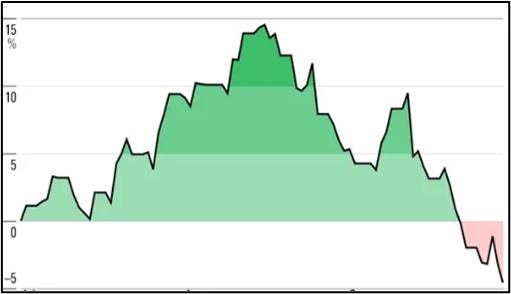

The three key indicators reveal which way the RBA is likely to act in the near future, but although inflation is falling, the rate is still above the RBA’s target of 2% to 3%, and the unemployment rate is still well below the RBA’s target maximum of 4.5%.

This means that it would require a massive fall in inflation with a simultaneous lift in unemployment in the next few months to motivate the RBA to cut interest rates.

However, there’s a third indicator, which is economic performance. The GDP figures for the December quarter showed that our economy is flatlining, so the RBA will be watching the next GDP figures due to be released on 5th June. If the economy is found to be contracting, it would only take a fall in inflation OR a rise in unemployment to motivate the RBA to lower rates.