The coming cash flow bonanza

Many investors are wary of buying properties in areas with a high percentage of rentals, perceiving them as being low income, socially disadvantaged areas with high levels of unemployment and public safety issues.

But, is there really any logic to this anti-rental stigma? Such negative thinking could even lead some of us to miss out on the huge cash flow bonanza which is about to be unleashed in many of our property markets. The first thing that investors need to understand is that locations with high numbers of renters are often also the most affluent and that for many households, renting is a lifestyle choice.

Most renters are young, professional opportunity seekers

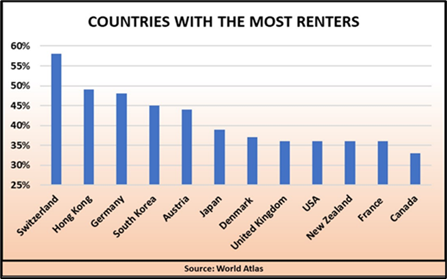

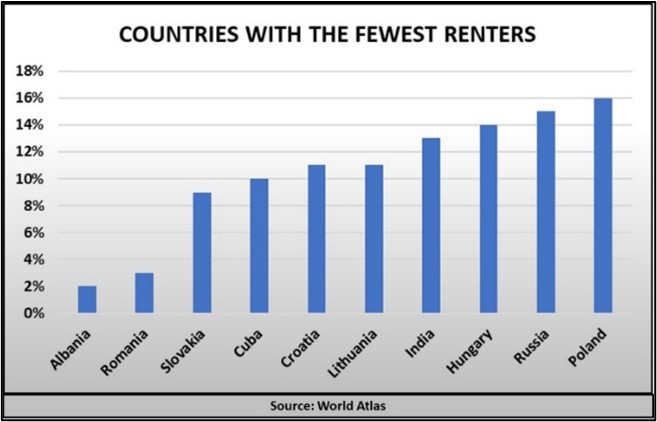

This graph shows you that wealthy countries with high per-capita incomes such as Switzerland, Hong Kong, Germany and South Korea, also have the highest percentages of renters.

In some countries such as Switzerland, the number of renting households even outnumbers those of owner-occupiers.

It’s a totally different situation in countries with low numbers of renters, such as Albania, Romania, Slovakia and Cuba which are also low income and even economically challenged.

This would seem to indicate that the higher the percentage of renters in a city, region or country, the more affluent or wealthy it is likely to be.

For example, many high income, aspirational young professionals choose to rent in inner high density suburbs such as Docklands, Southbank, Barangaroo, Fortitude Valley or Newstead because these locations offer a wealth of lifestyle, employment, education and entertainment options not available elsewhere. Not only is it cheaper for them to rent than buy, but they can live in an apartment which they could never afford to purchase anyway.

It’s critical that the numbers of the right types of renters is growing

While investing in an area which has the right type of renting households is important, it is also essential that their numbers are likely to increase, because this leads to rental shortages and rising rents.

Since February our international borders have been progressively opened to overseas arrivals, a process which was significantly increased at the recent Jobs and Skills Summit, with the announcement of 195,000 applicants to be accepted under the Work Visa process. They will be joined by thousands of Family, Student and Business Visa arrivals. The vast majority of these new arrivals will be young, aspirational opportunity seekers, and definitely the right type of renters.

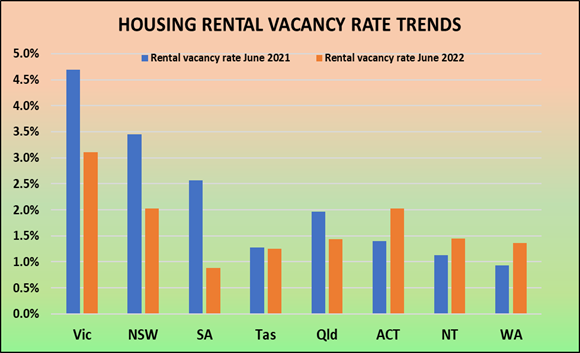

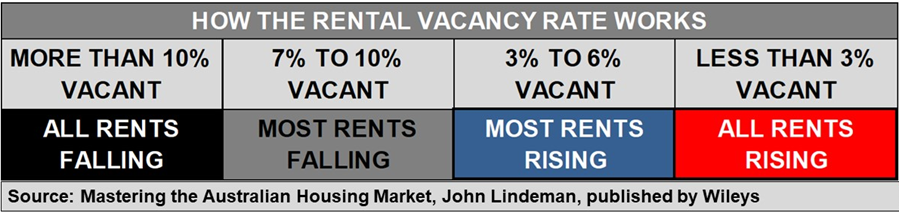

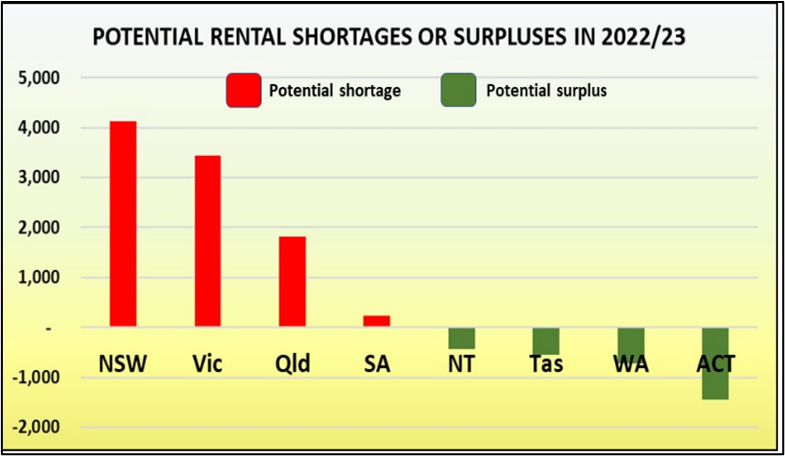

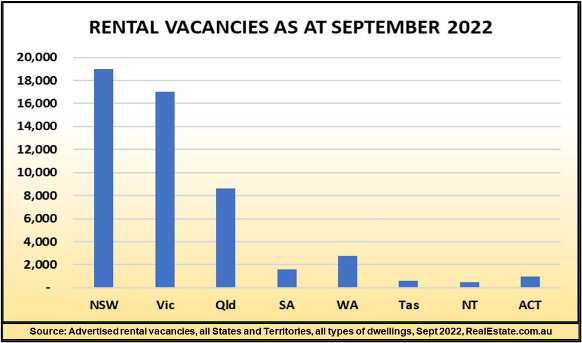

But when we compare their numbers to the total advertised rental vacancies in each State and Territory for all types of dwellings it is obvious that the numbers don’t stack up.

With only 51,000 rental vacancies in Australia, we are facing a massive rental shortage unlike any seen before.

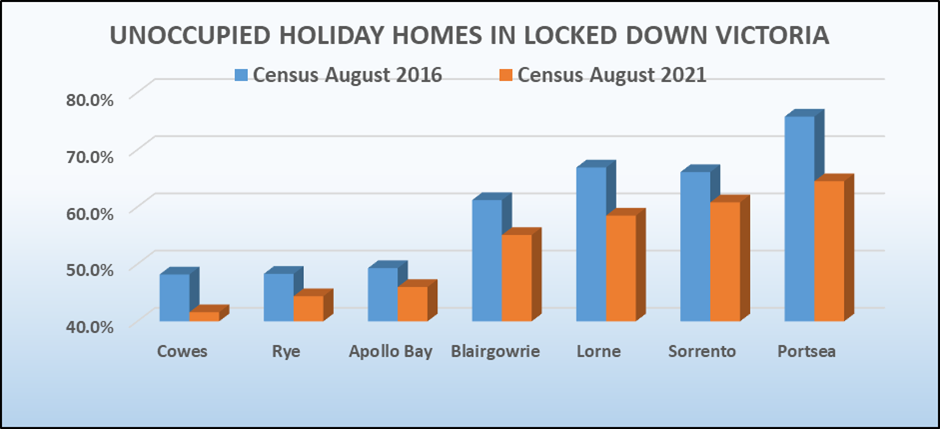

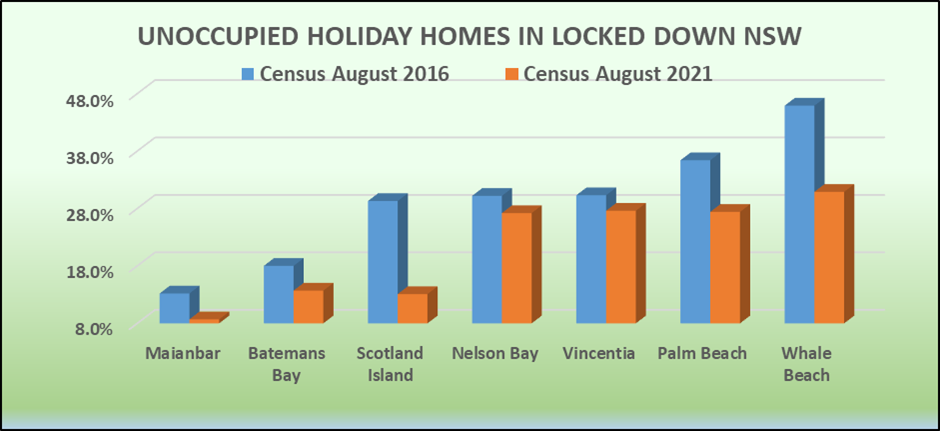

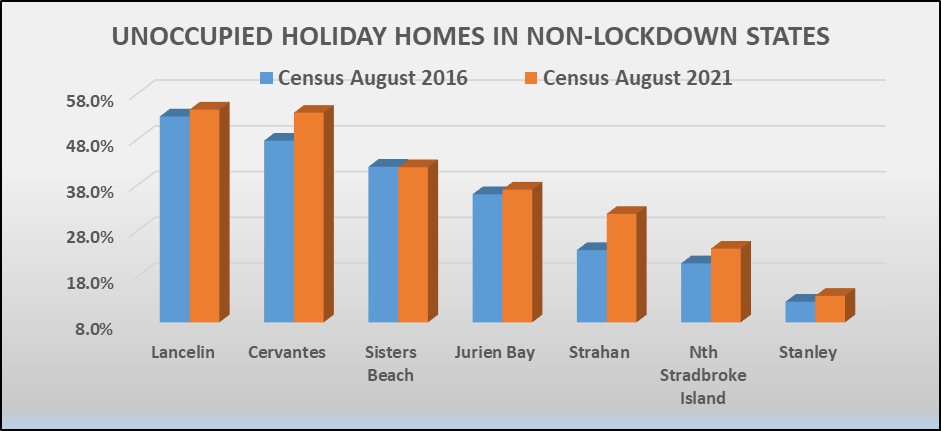

Such rental crises have been partially resolved in the past by renters reluctantly moving into boarding houses, temporary dwellings, granny flats, caravan and holiday parks, even hotels and motels, but the real solution can only be a massive increase in the supply of new rental accommodation. This turns up another issue, because the locations offering lifestyle, employment and education opportunities sought by renters are usually not the same as those preferred by developers.

As asking rents keep rising, this will generate a massive number of investors seeking high cash flow, but even then it is unlikely that the numbers of investors in inner urban locations will be sufficient to meet future rental demand and a huge cash flow bonanza is highly likely.