Knowing the right time to sell

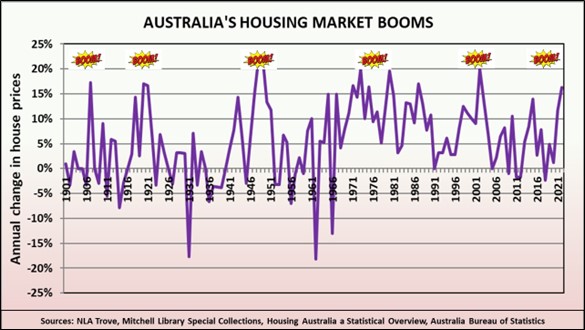

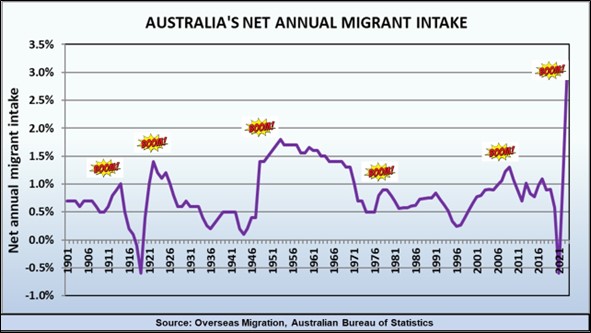

All property market booms eventually end, and so investors need to know when the time to consider selling has arrived. Property market expert, John Lindeman, explains which indicators reveal the right time to sell.

Property market analysts rely on many different indicators to look into the future and predict whether prices are likely to rise or fall. Some proudly advertise that they employ up to twenty five housing market fundamentals to make their forecasts, while others seem to rely only on gut feel, hearsay or intuition.

Here are the three most commonly used indicators, and John’s assessment of their usefulness to property owners.

Sale prices reveal past performance

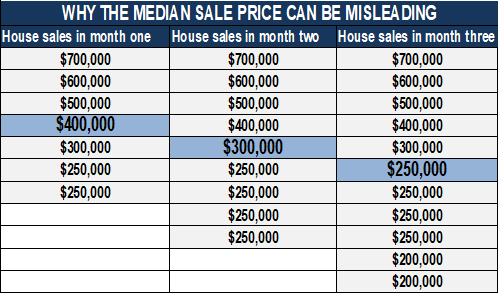

Sale prices are obvious indicators of a market’s performance. If prices are falling, it’s time to get out, some experts tell you. But the issue with published sale prices is that they are not predicting the future, only revealing the past.

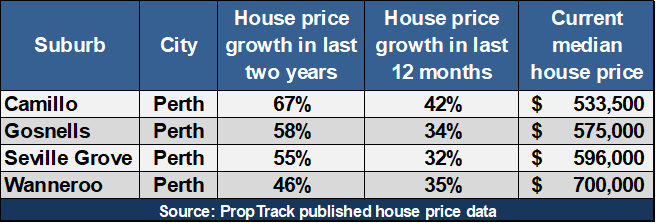

This table shows you the huge price growth that has occurred in four of the most affordable Perth suburbs over the last two years, and that the rate of growth actually increased in the last twelve months to October 2024.

Followers of strong past performance would have us believe that this price growth acceleration is a good indication of more growth to come.

Others will assure us that such high growth rates are unsustainable, and that the turning point could arrive at any time. The issue for investors is that we can’t tell from past performance whether more growth is on its way, or whether the market has reached its turning point and it’s time to sell.

The number of sales shows us changes in demand

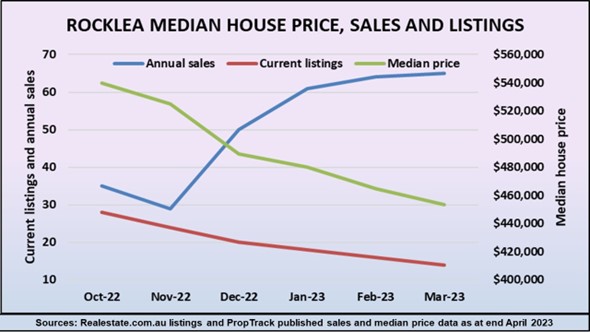

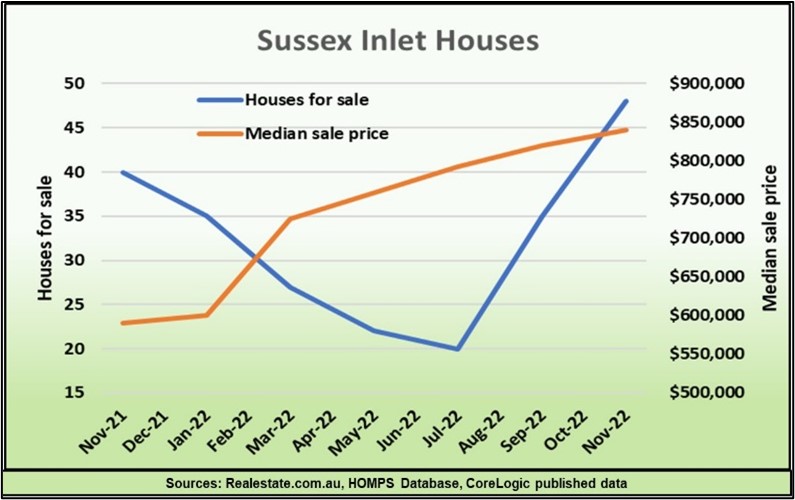

It’s much more useful to look at the actual trend in the number of sales rather than past sale prices.

This is because decreasing sales indicate that buyer demand is slowing down and are a sign that prices could soon be following.

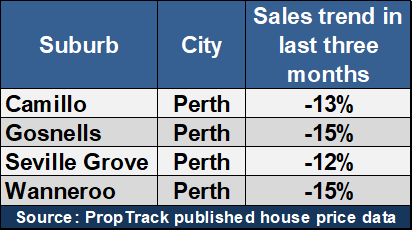

This table shows that the number of sales in the same four Perth suburbs over the three months to October 2034 has been declining.

While this may give property owners in those suburbs cause to think about selling, the problem is that sales alone do not provide a full picture because, like sale prices, they are based on past results. To look into the future we need to know potential buyer and seller intentions, which are indicated by changes in the number of listings.

The number of listings reveals changes in both demand and supply

If the number of houses or units listed for sale in a suburb increases, it tells us that buyer demand is falling or that more owners want to sell, or that both are occurring at the same time.

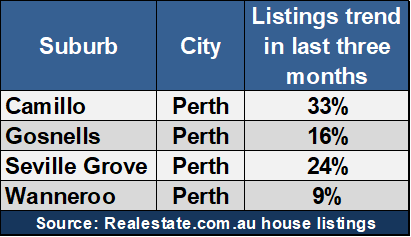

In those four Perth suburbs, we can see in this table that the number of properties listed in the last three months is rising.

The number of listings is called a leading indicator, because it points the way ahead. While the number of houses sold has been falling, the number of owners trying to sell by listing their houses on the market has been growing. If these trends continue, they could reach the turning point where prices will start to fall.

You can check the sales and listings trends for houses or units in any selected suburb to see which way they are moving. This will give you a much better indication of potential price changes than relying on past price performance.