Racing into a rental crisis

Australia is experiencing a population boom, mostly from overseas arrivals, many of whom will be renters for some years. John Lindeman explains that as a result, we are facing a massive housing rental shortage, and asking rents will soon be skyrocketing.

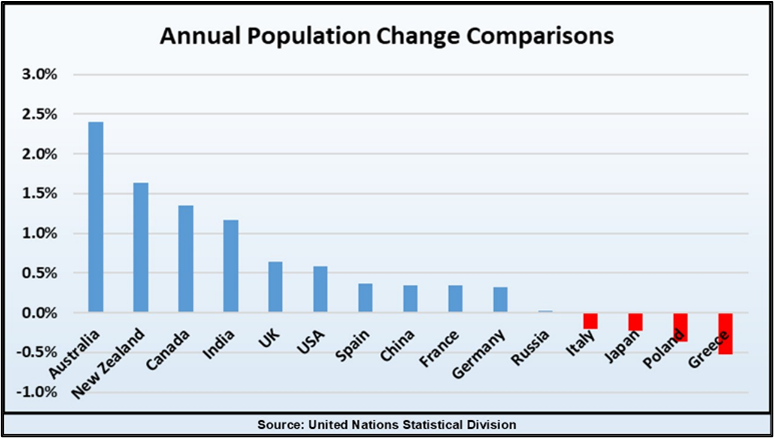

Australia’s population growth rate is quite different from most other countries, as the graph shows. While other developed nations are experiencing very low growth rates, or even falling populations, ours is one of the highest in the world.

Most of our new residents are overseas arrivals and the increased consumer demand they create keeps our economy in growth.

This means that our Federal Government is forced to keep the welcome to Australia doors open, at least for the foreseeable future.

Our population is projected to grow at rapid rates

According to the Bureau of Statistics, during the last year Melbourne’s population grew by over 140,000 and Sydney’s by more than 100,000, while Perth and Brisbane each increased by around 70,000. The Bureau expects our population to reach thirty-three million by 2033.

Eighty percent of the forecast growth in population will be from overseas arrivals who require immediate housing when they resettle here – and most of them will be seeking rental accommodation in our big capital cities.

This is becoming a huge issue, because we are not building enough homes to accommodate our growing population.

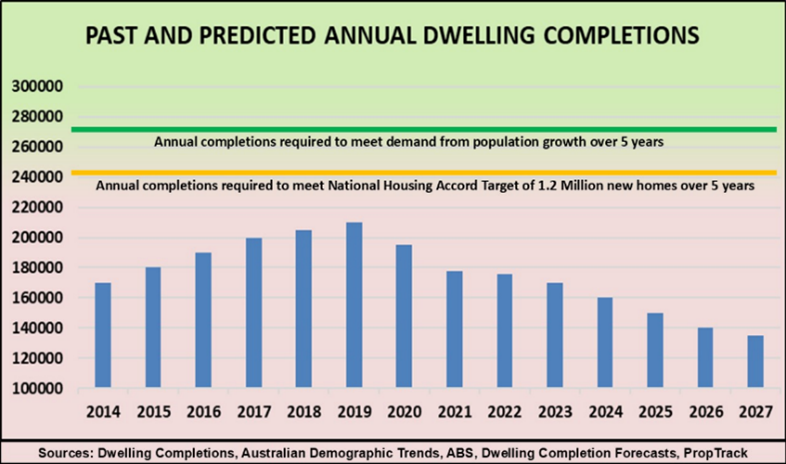

The number of new dwelling completions is trending down

As the graph shows, the National Housing Accord target of 1.2 million homes in five years will not be sufficient to meet the expected demand for housing and that’s not even a commitment – it’s only an aspiration.

The actual rate of completions is falling, and PropTrack forecasts that this trend will continue.

Based on these trends, we will only be meeting around half of the demand for housing expected from population growth over the next five years.

Rents are about to dramatically increase

Most of the demand for housing over the next few years will be for rentals and this is likely to dramatically escalate.

This graph shows that the last two decades of moderate rent rises came to a sudden end after the Covid pandemic.

The opening of our international borders was accompanied by huge numbers of permanent overseas arrivals, and a massive lift in weekly rents.

Over the next few years, rents are certain to dramatically increase further, especially in the inner suburban areas of our major cities. This is good news for investors seeking high cash flow, but bad news for renters.