Be cautious with the COVID Census

The last Census was conducted in August 2021, when our international borders had been closed for over eighteen months, State borders were firmly shut and the southern capital cities were in lockdown.

Much of the data illustrates the abnormalities that these restrictions on movement caused, but the stats also reveal how some people simply avoided them altogether by secretly slipping away to safety.

There have only been a few times when Australian’s have felt sufficiently threatened to make a run for safety, such as during the Second World War. Many Sydney homeowners feared invasion, and some fled over the mountains, returning when the danger was over. The new Census data has revealed that some people did the same thing during the pandemic.

There was a secret slip away to safety

People who were lucky enough to have holiday homes located away from the lockdowns, restrictions on movement and the COVID-19 threat itself were able to quietly relocate to the safety of their holiday homes until the danger had dissipated.

One of the most public of these slip aways was that of former NSW Arts Minister Don Harwin, who was fined $1,000 by police and resigned his portfolio when he was discovered living at his Pearl Beach holiday home in an apparent breach of the coronavirus public health orders.

Holiday homes were used as bolt holes

There are around one million holiday homes around Australia, mostly only occupied during peak holiday seasons, but the last Census, which was conducted in August when Sydney, Melbourne and Canberra were in lockdown, shows that many of these were temporarily occupied during the pandemic as bolt holes.

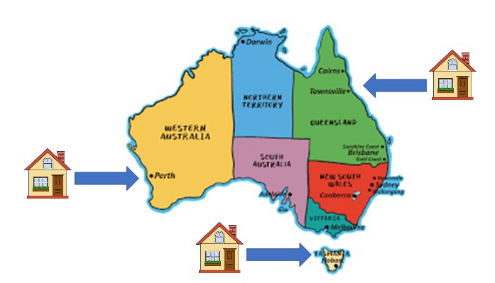

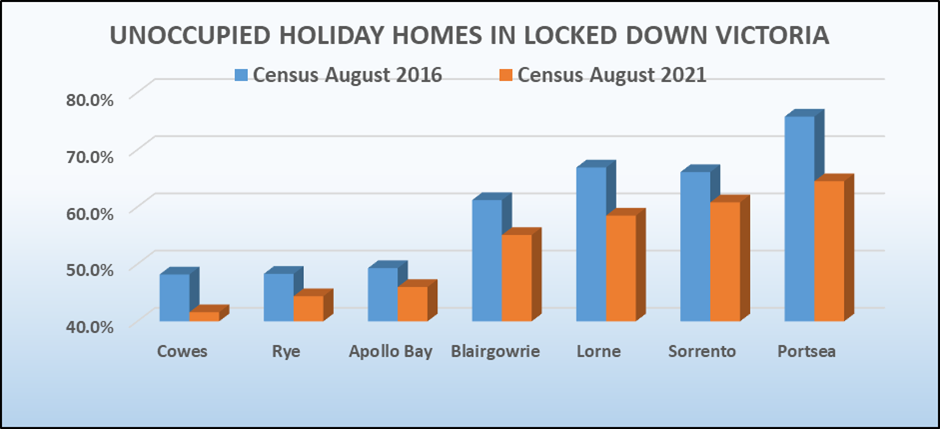

With Melbourne being the most locked down city in the world during the crisis, it’s not surprising that the percentage of empty holiday homes in regional Victoria fell dramatically when the 2016 Census figures are compared to last year’s “pandemic” Census. In other words, the number of holiday homes that were occupied during the Census actually rose, even though they would not normally have been occupied in August, when the Census is conducted.

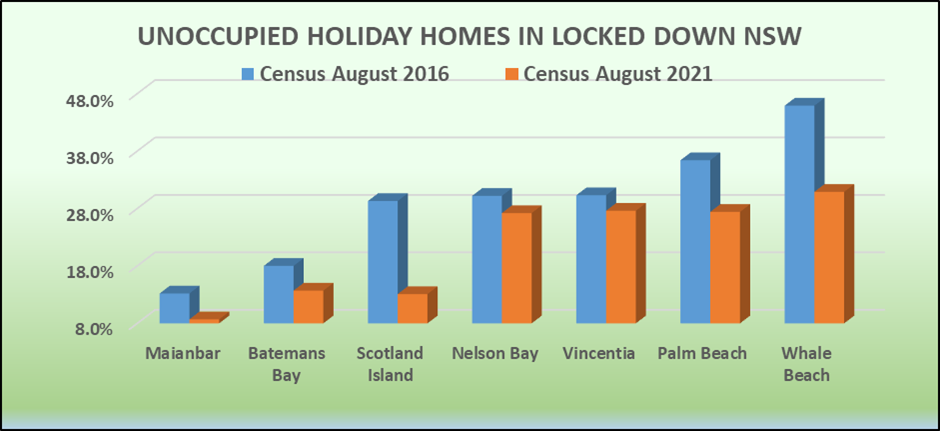

This slip away to safety also occurred in New South Wales with Sydney in lockdown during the 2021 Census. The figures show that the percentage of holiday homes that were occupied during the lockdowns rose when compared to the previous Census.

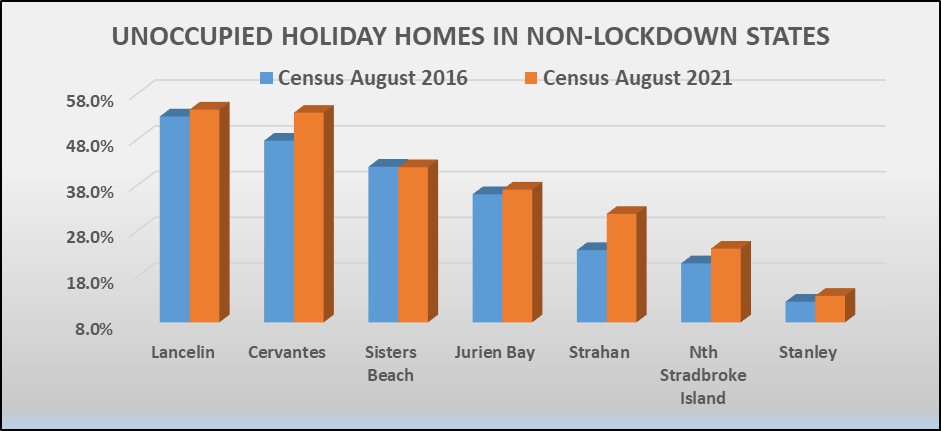

Empty holiday home numbers actually rose in no lockdown states

This flight to safety did not occur in States where there were no lockdowns in force at the time of the 2021 Census, as the data from some of the most popular holiday home locations in Queensland, Western Australia and Tasmania clearly shows.

It seems that many people in Sydney, Melbourne and Canberra slipped away not just to avoid catching the virus, but to get away from lockdowns, while there was no such motivation in Brisbane, Adelaide or Perth, where no lockdowns were in place.

Much of the 2021 Census data was skewed by the pandemic

The slip away to safety highlights the fact that last year’s Census was conducted at a very unusual time in our history. Much of the data collected was not typical, with closed international and State borders, restrictions on movement and lockdowns in place during the Census in many areas.

For example, rental demand in the Melbourne CBD collapsed during the pandemic because of closed borders and lockdowns. The number of unoccupied units trebled from 2016 to 2021 with nearly one third of inner Melbourne apartments being empty during the 2021 Census.

It’s a similar story in student precincts, where the number of students dropped dramatically as they returned home. Kelvin Grove is an inner suburb of Brisbane with several tertiary institutions and a teaching hospital. The number of student group households fell by 25% during the pandemic.

Tourism came to a sudden end in popular holiday locations and the number of workers in tourist related industries such as accommodation, hospitality, restaurants and specialist retail fell. As most of these are usually students and backpackers, rental demand collapsed as well.

While the 2021 Census data will still be extremely useful, this is one Census where the information will need careful checking to see if the data may have been skewed by the impact of restrictions on movement, lockdowns, interstate travel, social distancing and international border closures that were in place at the time. And of course, the stats show us that not all people obeyed the health regulations and simply fled to the safety of their holiday homes until the lockdowns were over.