Facing the biggest fear of all

Buyer demand is falling in all our property markets, yet the cause of this hesitancy is not solely due to interest rate rises, but the fear and even panic that rate hikes create about possible housing price falls or even crashes.

This fear of the unknown explains why potential property buyers are holding back, even though most of them either have no need of housing finance or are relatively immune from rate hikes.

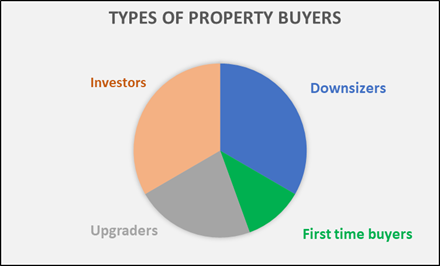

The chart shows that thirty per cent of homeowners have no remaining housing debt, and have no need of housing finance when they buy another home.

Another thirty per cent are investors who claim the cost of housing finance interest and can also raise asking rents to recoup the cost of interest rate rises.

Twenty per cent are upgraders who purchased their homes many years ago when rates were much higher than they are now and for whom a rise in interest rates is quite manageable.

The remaining ten percent are first home buyers who need to borrow most of the price of a property. In theory, this segment of the buyer market is the only one that is directly hammered when interest rates rise, because higher rates reduce their buying power.

Why buyer demand has slowed down

Yet buyer demand has fallen in every market and from all types of buyers, because we become scared about what might happen to prices generally. Fear is one of our strongest survival instincts and facing the unknown is one of our biggest fears. This is why potential buyers are holding back, waiting to see if more rate rises are coming, leading to a property market crash. Even though the experts assure us that all is well, our instincts take over, urging us to wait until the dust settles.

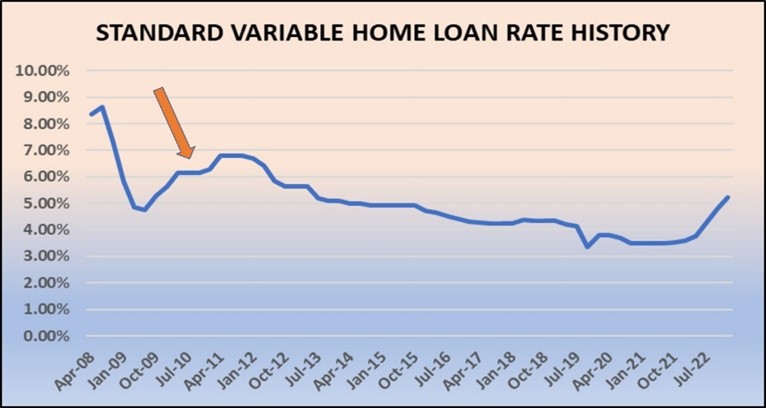

The best way to analyse this phenomenon and the possible outcomes is to look back to the last time that interest rates took a significant upwards hike, which was in 2009-10. (Shown with the red arrow in the graph.) This is because some bank economists are forecasting that a similar rate hike is likely to occur again and that savage falls in property prices will occur as a result.

The rate rise in 2009-10 was the biggest in modern history, but the graph shows that it took the RBA more than a year to implement.

We then had a series of interest rate reductions over the next eight years until the home loan rate was lower than it had been before.

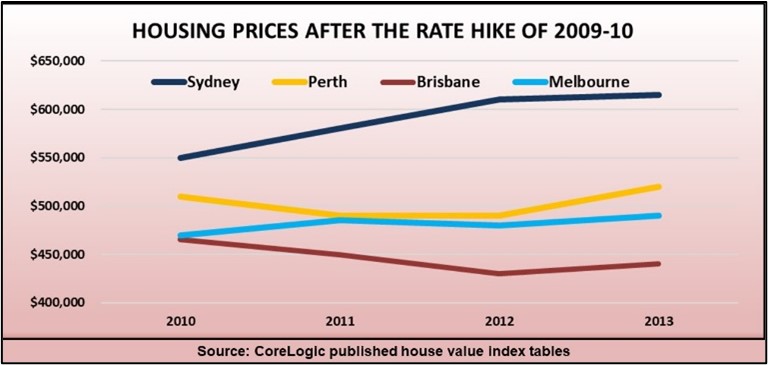

There were no crashes the last time rates rose significantly

What happened to property prices as a result is shown in the graph below. Buyer demand slowed, but while prices fell slightly in cities such as Brisbane and Perth over the next few years, there were no price crashes, and prices kept rising in Sydney and Melbourne although growth was more subdued.

The reason that rate rises don’t lead to property market crashes is that only a small percentage of homeowners are directly impacted, and even fewer are forced to sell because they can’t manage their repayments. The majority simply wait until some certainty returns.

Confidence gradually returned to the property market as interest rates started falling from 2011 onwards and this is exactly what is likely to happen again. In other words, once rates stop rising and it’s obvious that the market is not going to crash, buyer and seller demand will pick up again.