Perth’s housing market is set to boom

According to property market analyst John Lindeman, all the indicators are pointing to an imminent Perth housing market boom. A thriving economy, massive labour shortages, huge population growth forecasts, the most affordable buy prices of any State capital city, plus an acute and increasing shortage of accommodation.

Australia is such a vast and varied continent that property market booms can always be found somewhere. When market slowdowns occur as they have in most areas over the last six months, we only need to look for other markets which have the potential to boom while the others are in gloom.

Right now, Perth is the standout property market for investors, with our highly accurate and patented housing market prediction solution forecasting both positive cash flow and strong price growth for the city.

This prediction was supported by our recent on the ground research trip to Perth. We discovered a positive and vibrant city ready to boom.

Western Australia’s economy is booming

Underpinning our boom prediction is the Western Australian economy, which is going gangbusters. The State generates half of Australia’s resources export income from iron ore, petroleum, gas, gold, nickel and other minerals. With China buying one third of our exports, the Western Australian economy stands to be the biggest beneficiary of any improvement in trading relations with China, so it’s encouraging that the Australian government is actively patching up diplomatic relations with China.

There is a massive shortage of workers

The State’s growing economy has led to a massive shortage of workers, especially in Perth. The State has one of the lowest rates of unemployment at 3.4% and the highest participation rate of all our States. For the first time in recorded history, there are more advertised job vacancies in Perth than there are people looking for work. These figures indicate that the State needs more workers, and needs them urgently.

High population growth is forecast

As a result of the acute labour shortage, the State Government is actively promoting Western Australia as a destination for skilled work regional migrants (491 Visas) and has successfully lobbied to have all of the State declared a designated regional area.

This means that skilled migrants on regional 491 visas can arrive, live and work in Perth, the only capital city which has achieved this distinction. In addition, the government has waived Visa application fees, dramatically increased the list of available occupations, removed the requirement for applicants to demonstrate that they have sufficient means of support on arrival, and reduced minimum English competency levels.

A massive rental accommodation crisis is looming

Perth is already experiencing a shortage of rental vacancies, with rental vacancy rates below one percent, but according to the government’s Western Australia Tomorrow forecasts, the State is expected to receive 25,000 net overseas arrivals each year, most of whom will be renters.

According to Realestate.com.au, there are currently only 2,100 advertised rental vacancies in Perth, and just 2,800 in all of Western Australia, which includes all types of dwellings.

This indicates that a massive rental supply issue is about to hit Perth as new arrivals and others looking for accommodation will have to compete for the few available rental properties.

Perth has a huge housing supply shortage

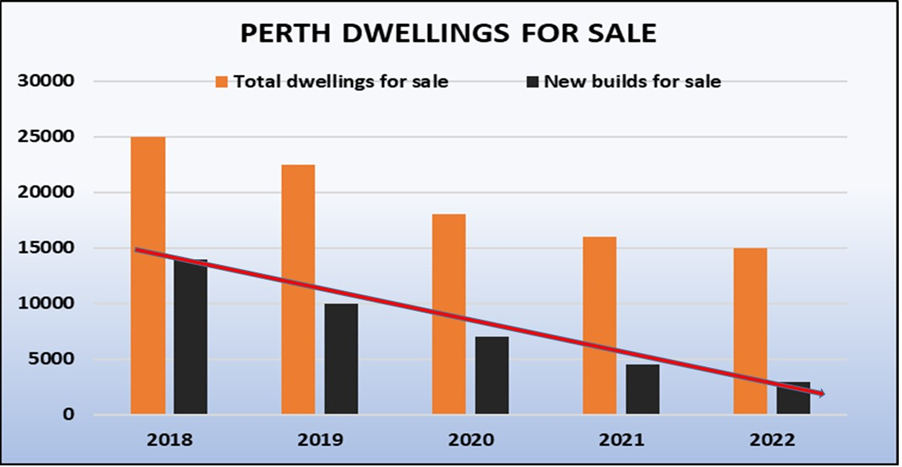

Not only does Perth have an imminent rental supply issue, but there is a general shortage of new housing stock. Because property values have not grown in the last eight years, it is now far cheaper to buy an established house in Perth than to purchase a new build with similar features.

The rate of new builds has reduced so much, however, that the market has reached a turning point, with not enough new dwellings listed for sale to meet buyer demand. At the current rate buyer demand, Perth only has three months of stock available on the market and property buyers are being forced to compete for established dwellings, pushing prices up.

Perth’s housing market is less susceptible to interest rate hikes

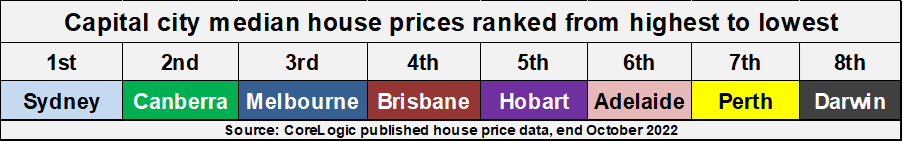

With most buyers in a state of shock following seven consecutive rate rises, the impact is likely to be far less in locations where buyers need to borrow less to purchase a property. When we order capital cities by their median house prices, we see that Perth is currently ranked seventh, which is the lowest it has ever been and the first time that Adelaide’s median house price has been higher than Perth’s.

Perth’s comparatively low buy prices not only lessen the impact of higher interest rates, but they will also attract both local and interstate investors. Asking rents will soon turn Perth into the only city with positive cash flow opportunities and this will be followed by a massive lift in housing prices, as investors and home buyers compete to purchase properties.