How to predict cryptocurrency performance

Many investors are tinkering with cryptocurrencies and wondering where they fit in a properly balanced portfolio. John Lindeman reveals their true place in the investment matrix, and explains how they are likely to perform in future.

Bitcoin was promoted as “digital gold” after a meteoric rise in price following its launch around fifteen years ago. Despite some spectacular crashes, cryptocurrency advocates still insist that they are a secure form of investment, being high tech, innovative, blockchain based and disruptive.

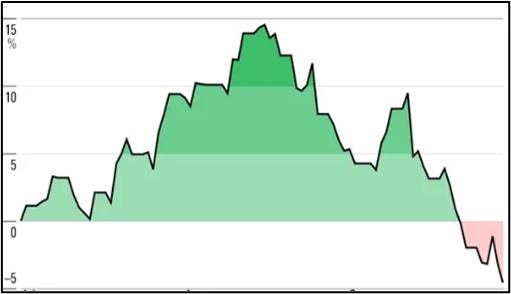

This conveniently ignores their extremely volatile recent performance. For example, Bitcoin’s price has swerved from a high of $93,385 to a low of $25,663 in the last twelve months, and this highly volatile performance gives investors no real clue to its potential performance. It is clear that cryptos do not perform like gold, savings or property, so how can investors make informed trading decisions?

Crypto investors are increasingly using the stock market as a guide

Without any reliable forecasting guide, cryptocurrency investors are reacting to market indicators such as inflation, interest rates and investor confidence in the same way that stock market investors do. This is because shares and cryptos have many features in common, such as the ease, speed and low cost of trading, plus of course, their volatility.

The result is that more cryptos are purchased when investors are buying shares, and more are sold when share investors are also selling.

So, cryptocurrencies are starting to perform as if they were pseudo shares, but there’s one crucial difference between cryptos and shares.

Shares represent real equity, not virtual keys and wallets

Shares represent equity in a company, so you are “sharing” ownership of the company itself. The better that a company performs, the more investors will compete to buy its shares. But, when you buy cryptocurrency, you don’t own anything other than a private key and a digital wallet, so the value of your investment is controlled entirely by notional demand or the lack of it.

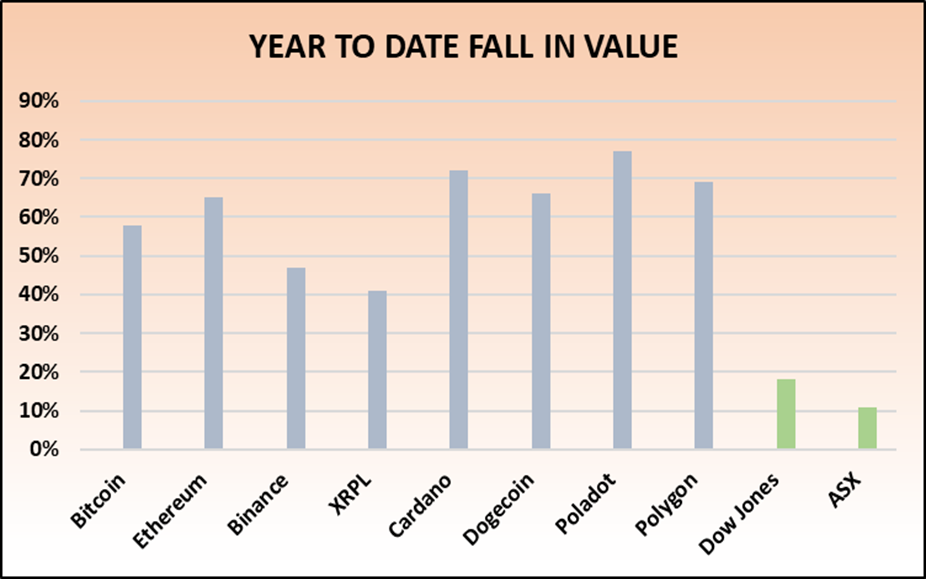

This means that while the direction of crypto prices will generally mirror that of the stock market, the intensity of change is likely to be much greater, which is exactly what we have witnessed this year.

The graph shows that year to date falls in major crypto prices have been far more severe than those experienced by the Dow Jones or ASX.

The growing link between share prices and cryptos indicates that any stock market recovery should be accompanied by a massive rise in the price of many cryptos, but which ones? There’s no guarantee that yours will be one of them. This is why Investors should treat cryptos as a high risk boom-bust investment option, offering the same wild roller coaster rides as speculative shares which are bought on hope rather than sustainable business models.