Artificial intelligence and the property market

Artificial intelligence is finding its way into almost every facet of our lives. John Lindeman investigates its potential role in property market analysis and prediction.

The main purpose of artificial intelligence (AI) is to develop computer systems which are able to perform decision making tasks normally made by humans. As far as property investors are concerned, the best AI systems should reveal where we can buy for the strongest future growth or cash flow, what type of property will deliver the best results, and when the right time to sell has arrived.

There are hundreds of indicators, stats and numbers to choose from

The issue for the developers of such AI systems is determining which of the huge number of indicators and stats that are routinely quoted and relied on by property market commentators to make use of. Here are some of them:

The AI analysts and programmers have to decide which of those numbers simply don’t work, which ones do and what these numbers are actually telling us about the property market. Then they need to develop working artificial intelligence algorithms using them to make predictions. This means that the data must be recorded and checked against actual performance over long periods of time so that meaningful conclusions can be made.

Stats can be limited or general, and also short or long term

Stats which rely on current trends such as sales and listings can only estimate imminent price or rent changes, while others, such as migration and unemployment rates have a longer time window. The issue is further complicated because some stats have an effect on entire markets, while others only measure local changes.

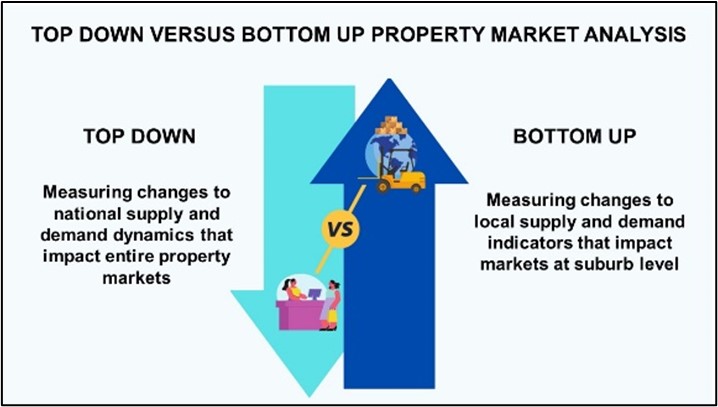

Some stats such as interest rates and consumer confidence are called “top down” indicators because they can change buying and selling trends for whole cities or even the entire country.

Other stats, which are “bottom up” indicators such as sales and listings can be used to measure potential performance in individual suburbs.

Many experts retreat to the safety of the property market cycle

If you’re confused by all this, you are certainly not alone. Many strategists and theorists throw their hands up and claim that we can’t accurately predict future property market performance at all. They retreat to the assumed safety of relying on past performance, or the property market cycle and the property clock.

Whether artificial intelligence can make useful property market predictions does not depend entirely on what data is used and whether the predictive algorithms are accurate. The main stumbling block is that artificial intelligence can only predict where, when and what, but can’t reveal why.

Knowing the reason why changes occur is often the key to understanding the future performance of any property market. Why is buyer demand for certain types of property increasing? Why is the rental demand falling?

Even the best tested predictive algorithms and methodologies will always need to be confirmed by conducting thorough on the ground research and getting answers to the question “Why?”