The importance of size in property markets

When property investors talk about size, they are referring to population. Some won’t even consider a potential investment location unless there are at least 5,000, or 10,000 or even 20,000 people living there, but is there any logic to using size as a benchmark?

Size is one of those accepted truths about the property market. It’s based on the fact that people create economic and demographic diversity, so the bigger the local population, the more robust and stable its housing market is likely to be. This is why many property investment courses and books tell you to limit your search for possible investment properties to towns or even cities with a certain minimum population.

Population size can be misleading

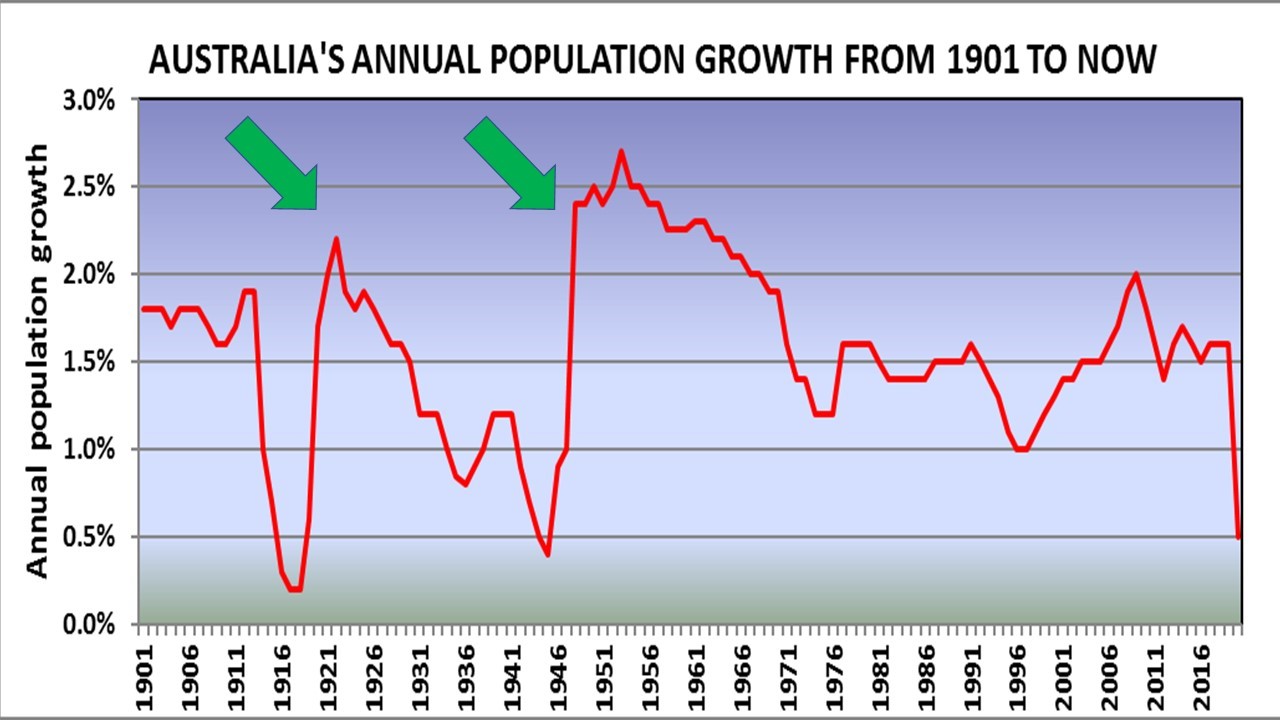

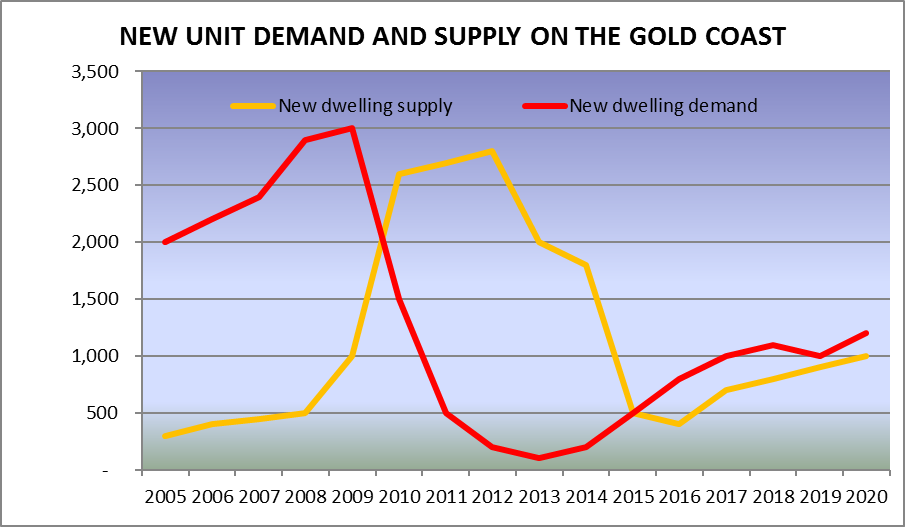

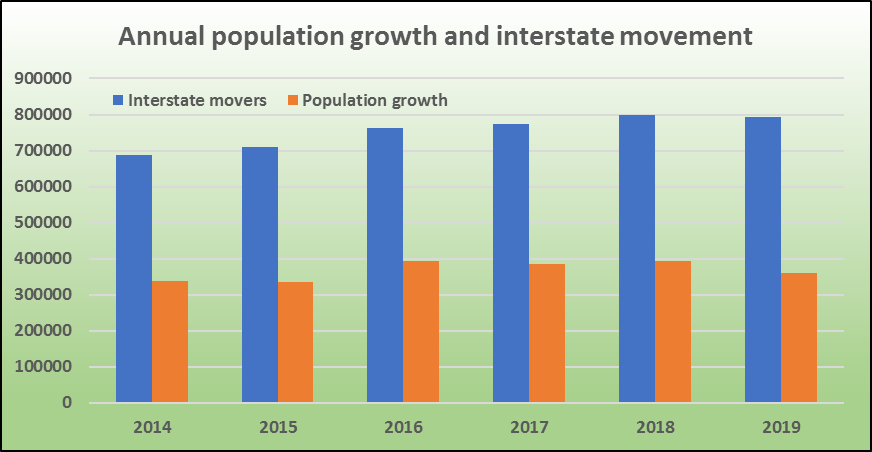

I would argue that it’s not the size that matters so much as whether the population is growing or declining, because population falls cause lower demand for housing, leading to falling prices, longer rental vacancy rates and lower rents, regardless of how big a city might be. On the other hand, population growth, even in a small town will generate more demand for housing.

It’s also critical to know what types of households are moving into an area, and what types are departing. For example, a recently completed highway expansion or new railway project could result in many of the construction workers who rented in town leaving, but also motivate home buyers to move in, because the area is now quicker, easier and safer to access.

Market activity is more important than size

Much more important than an area’s size is the amount of property market activity that’s taking place there. You can easily check this by looking up the property sales, rental vacancies, listings and time on market in any suburb or locality.

Even a small town might be buzzing with new buyers or renters and you might miss an obvious investment opportunity if you rely purely on the town’s size.

Size does not guarantee economic stability

Even some large Australian cities rely heavily on one or two main industries to provide employment and economic growth such as tourism, manufacturing, horticulture or mining. If these key industries decline there’s a knock on effect to other local industries such as retail, entertainment, educations, and administration and so the property market suffers.

The important thing to look for is not diversity, but whether the main industry in a small town has growth potential, because this will also have a knock on effect to other industries in the town and lead to more housing demand.

For example, the arrival of over 1,000 construction workers in remote Weipa (total population of 4,000) led to a massive and sustained rise in both rents and prices.

When doing your research for potential investment areas, don’t just rely on size, but also look at expected growth in population, increasing property market activity and new or expanded economic projects.