Tips and Traps of buying overseas

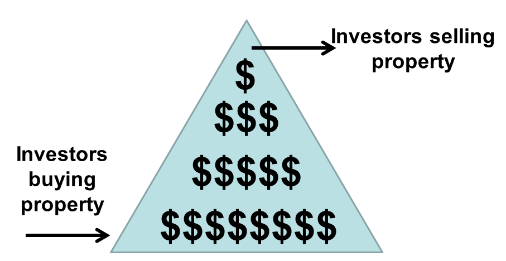

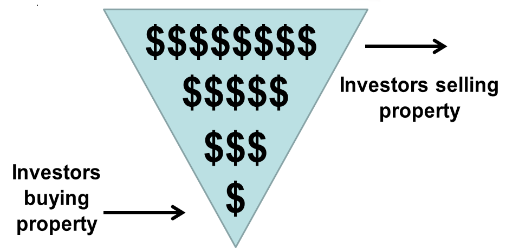

As price growth in our housing market slows down and some areas are experiencing price falls, many investors are once again turning their attention to buying overseas.

John Lindeman reports that you can’t buy a property in some countries unless you are a citizen, while buying property in others can earn you a residency permit.

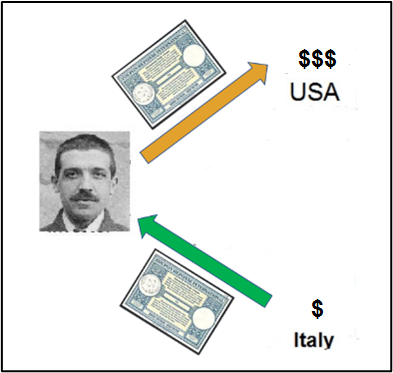

You can even buy a villa or even an entire estate in some parts of Italy for €1. Yes, that’s right, just one euro. So, what’s the catch?

Many houses in Italy’s most picturesque locations have fallen into decay as their owners pass away and younger people move away.

To combat the issue, authorities in regions such as Sicily, Sardinia and Tuscany are offering these once grand villas and even whole estates at buy prices of only €1.

The only condition is that buyers must renovate their properties. The aim is to restore towns with medieval, Saracen or even Roman heritage buildings that have fallen into disrepair and boost local economies by encouraging more tourists to visit.

Buy a property in Spain and receive an honorary residency permit

Some countries enthusiastically welcome overseas property buyers, with Spain and Portugal even offering residency permit enticements to foreigners who buy a property worth over €500,000.

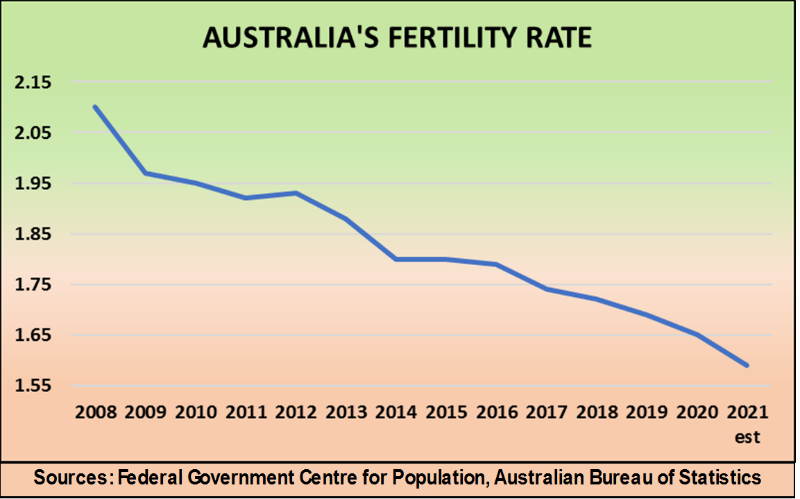

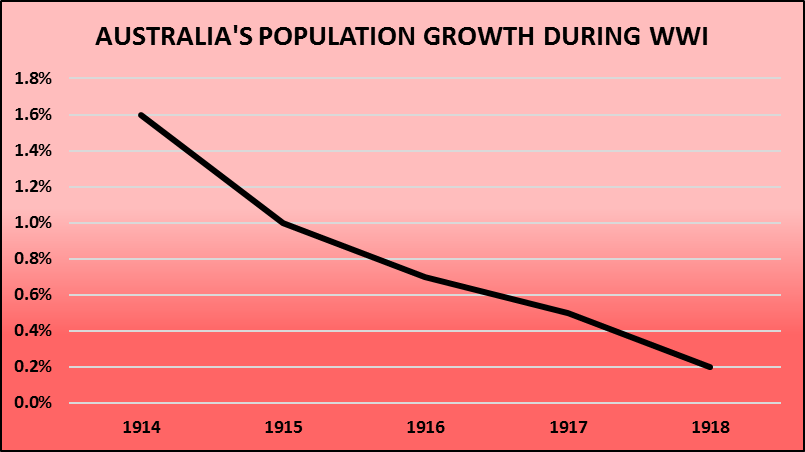

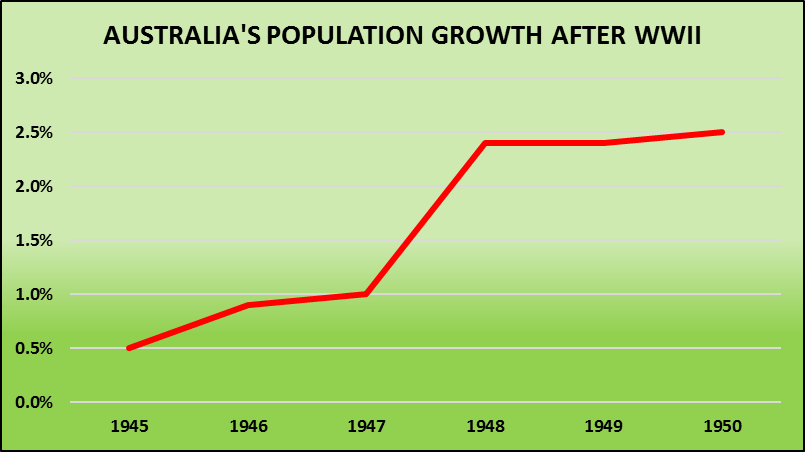

This is because housing demand in many European and Asian countries is flat as their populations decline. Not only are fewer babies being born, but young people are also emigrating.

You can’t buy a property in Switzerland unless you are a citizen

The opposite applies in Switzerland, where the government is charged with discouraging foreign immigration and restricts property ownership to those people who are citizens. But before you jump into foreign home ownership, it is also important for you to know the tax and legal systems that apply, as they could be very different from ours.

Beware of wealth, property, value added and inheritance taxes

For example, if you rent out the property during your absence, both the local country and Australia may tax your income from rent, unless Australia has an arrangement with the other country which takes the tax you have paid overseas on rental income into account.

Most countries have a capital gains tax, plus an ongoing property tax similar to our state-based land taxes, but some also have property related taxes that do not exist in Australia.

These include value added tax, which is applied to improvements made by the owner, wealth tax applied to properties worth more than certain amounts and inheritance tax which kicks in when the property passes to beneficiaries.

In some countries, inheritance tax is low or non-existent when properties are left to spouses or children, but become onerous when estates are left to others, or if immediate family are bypassed in a will.

And on the subject of inheritance, it is worth noting that some countries oblige you to leave your property to your next of kin in accordance with the established practice of the country.

This means that your lover or mistress, if you have one in France, is entitled to a share of your French estate when you pass away. This could be quite a shock to the family back home!